In this part of the world people love license plates with low numbers or easy-to-remember numbers, like 300003 or 515151. They will pay a premium for plates with low/cool numbers. This applies to phone numbers as well, and some numbers can run into tens of thousands of riyal. The phone companies know this, they're not stupid, so when they issue numbers you have to pay extra for nice numbers.

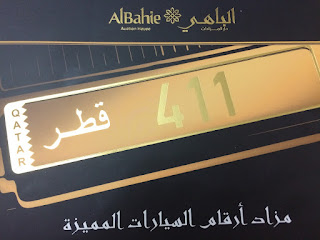

As for license plates one way to sell nice plate numbers is to auction them. There was an action recently by the AlBahie Auction House, I only knew about it when I saw a catalogue sitting around a friend's majlis.

All-colour, glossy, with a full page dedicated to each plate number that was available. A bit over the top? Not until you read the prices, for example:

Nice low number (most plate numbers are 6 digits), a bit of a pattern, so how much for this? I'm not sure if you can make out the lower right corner, it says:

Estimated price: 2,700,000 - 2,900,000 QAR

Starting price: 2,600,000 QAR

So the starting price is US$712,000 !! For a license plate.

And while that was definitely one of the more expensive ones it wasn't the most expensive. That was the 411 plate on the cover, inside the catalogue it notes an estimated price over US$1,000,000 ! Many of the other plates available were going for a more modest US$80,000-200,000, depending on the number on the plate.

I'm not sure why people are willing to pay so much for a number plate but it clearly a lucrative business. Many people in Qatar earn good money buying and selling license plate and phone numbers. If you look at the classified of the Arabic papers there are usually a lot of ads selling numbers.

I'm not saying it's wrong, people in the West can pay huge sums of money for things like stamps, coins, signatures or memorabilia, it's just something I'm still not used to.

So if you see a low license plate number in Qatar chances are someone paid a lot of money for it.

In 2006 I moved to Qatar and things are not what many people in North America would expect - it is not like how the Middle East is portrayed in the media. I'm also a fan of skepticism and science so wondered how this works here in Qatar. Since I'm here for a while I figured I'd use the time to get to know this country better and with this blog you can learn along with me. - - - - - - - - - - - - - - - - - - - - - - - So what posts have been popular recently . . .

Friday, May 27, 2016

Sunday, May 22, 2016

Qatar Weddings on Instagram

I always post about weddings that I attend, and there was one last weekend up in Al-Khor. Really nice tent, lots of guests, sword dancing, all in all a good time.

While a men's wedding is relatively casual compared to most Western weddings (no gifts, no pressure to stick around -- you can just show up to give your congratulations and leave) for Qataris showing up is still a serious matter, two of my friends rescheduled a vacation just to make sure they could attend the wedding, even though they'd be there for maybe an hour or so. What's important is that you were there.

Anyway, this time the groom had an e-invitation that he sent around, something that is becoming more and more popular. The invitation has a picture of the groom on a black background with the details of where/when the wedding celebration will take place. From this I learned that there are instagram pages where grooms post wedding invitations and people also post pictures from the wedding.

So if you would like to see a lot of pictures from Qatari Weddings, as well as invitations, check out https://www.instagram.com/a3rasqatar/. You'll get a good idea of what a wedding celebration is like.

While a men's wedding is relatively casual compared to most Western weddings (no gifts, no pressure to stick around -- you can just show up to give your congratulations and leave) for Qataris showing up is still a serious matter, two of my friends rescheduled a vacation just to make sure they could attend the wedding, even though they'd be there for maybe an hour or so. What's important is that you were there.

Anyway, this time the groom had an e-invitation that he sent around, something that is becoming more and more popular. The invitation has a picture of the groom on a black background with the details of where/when the wedding celebration will take place. From this I learned that there are instagram pages where grooms post wedding invitations and people also post pictures from the wedding.

So if you would like to see a lot of pictures from Qatari Weddings, as well as invitations, check out https://www.instagram.com/a3rasqatar/. You'll get a good idea of what a wedding celebration is like.

Wednesday, May 18, 2016

The Spread of English in the Gulf

People who have never been to this region would be surprised to learn just how widespread English is. In Qatar, Kuwait, UAE and Bahrain signs are in both English and Arabic, and most shopkeepers speak it. In Qatar you can even deal with Government offices in English, and IDs and drivers’ licenses are in both languages.

While historically dealing with the British and Americans (and their oil companies that set up in the Gulf) certainly helped I think the main reason for the spread of English was all of the expats that came to the Gulf to work in the service sector or construction jobs. Millions of people in the Gulf are from places like India, Pakistan, Philippines, Sri Lanka, and Nepal, countries where Arabic is not spoken. English, even if it’s only a few dozen words, will be spoken by most people from these areas, which allowed them to speak with each other. A Sri Lankan is unlikely to know Tagalog but if he can speak some English he shouldn’t have much trouble talking to a Filipino here. Over time locals learned English just so that it was easier to communicate with shopkeepers, waiters, servants and so forth.

As the GCC economies grow, and more and more non-Arabic expats move in, there have been growing concerns about Arabs losing their language, and English becoming their primary language. The concerns have been going on for years in Qatar but recently criticism of “cultural erosion” has been growing stronger, and the Government is now drafting laws to ensure Arabic is used in Government offices.

One of my Arab friends is so concerned about it he’s been making sure his children learn only Arabic (including not putting them in English-language schools), allowing them to learn English once they get older and are fluent in Arabic. Naturally they learn some English as they grow up in Qatar, it’s hard not to, but they don’t have formal schooling in it until they are teenagers.

So is that a bit overboard? Is it really such as issue? Well, I just recently got back from a business trip in the UAE and there I met some Emiratis who were at the seminar that I was attending. So I tried speaking to them in Arabic (classical Arabic of course, not the local dialect) when one turned to the other and, laughingly, said,

“Hey, his Arabic is better then yours.”

That confused me. I am by no means fluent, in fact I struggle to have even basic conversations, and if anyone speaks in regional dialects I have no clue what they are saying. But over the course of our conversation I was told by him that, indeed, he was not fluent in Arabic. Now it turns out that his mother was not an Arab so it’s unlikely she would speak to him in Arabic. He mentioned how he went to English-language schools, and in Dubai almost no one uses Arabic for everyday conversation, so he never became fluent in it. I’m sure his friend was joking that my Arabic was better than his, just needling him a bit about his lack of fluency.

Was this a one-in-a-million occurrence? When I mentioned it to my friends they were a bit surprised so I am assuming it is rare for a Gulf Arab to not be fluent in Arabic, but none-the-less it did serve as an example for why citizens of the Gulf are becoming increasingly concerned about losing Arabic. Over the years I’ve heard rumours and tales of other Arabs, raised by foreign nannies and going to English-speaking schools, who essentially had English as their first language. I’m not sure how true it is or how widespread the issue is becoming though.

I would recommend to anyone planning on staying in the Gulf for a while to try to learn some rudimentary Arabic. Arabic speakers really do appreciate it when foreigners have a basic knowledge of the language, not because they expect you’ll be fluent but they like that you at least made an effort to learn some of the language. It’s not an easy language but give it a try, maybe with lessons at Fanar to start.

Sunday, May 08, 2016

10 Years in Qatar

Wow, I've been in Qatar for 10 years! It's a milestone, and for many Western expats 10 years is pretty rare. I recall once I started hitting around 8 years many expats would be like, "What, you've been here x years! OMG!". I'm not sure why people who moved here in the last few years would have that reaction, while the weather can be a bit annoying Qatar has a lot going on. Huge developments, parks, malls, museums, nice dining options, I'm not sure why people now find it so surprising someone would stick around. 10 years ago Qatar was very different and when I think of the things that weren't available when I first arrived it's pretty surprising: Souq Waqif, Villagio, the Pearl, most of the hotels, the museums, Aspire Park, three-quarters of the buildings in West Bay, and so forth. So much was built in the last 10 years.

To celebrate the anniversary here's some photos of Qatar that I took back in the day, try to figure out where some of these were taken:

And how things have changed in my life as well. 10 years ago it was hanging out with Westerners at bars and buffets. Now almost all of my friends are Muslim so it's now majlises and cafes. Ramadan went from being a bit of a drag to a new experience. Travelling in the region went from being exotic to being more what I'm used to.

My current view is that I'll stick around as long as Qatar wants me to.

To celebrate the anniversary here's some photos of Qatar that I took back in the day, try to figure out where some of these were taken:

And how things have changed in my life as well. 10 years ago it was hanging out with Westerners at bars and buffets. Now almost all of my friends are Muslim so it's now majlises and cafes. Ramadan went from being a bit of a drag to a new experience. Travelling in the region went from being exotic to being more what I'm used to.

My current view is that I'll stick around as long as Qatar wants me to.

Wednesday, May 04, 2016

Italian Suit Scam comes to Doha

See if this is familiar to you . . .

Today I was out for a walk in the neighbourhood when a car pulls up to ask me for directions. The two guys said they were Italian, from Milan, and were in Doha for a fashion show (really? Doha doesn't have a lot of those.) and needed directions to their hotel. I gave them directions and they were so grateful he gave me a business card and wanted to give me a "gift". They had a lot of extra high-end designer suits in the trunk, and could sell some to me at a huge discount. They said they were flying out tonight and didn't want to take the suits back with them as it would be subject to customs tax.

I said no thanks and got out of there fast.

Why, because it's the Italian Suit Scam! The following links tell how it works (you're paying a lot of money for cheap knock-offs)

http://scam-detector.com/face-to-face-scams/italian-fashion-man

http://gothamist.com/2014/06/05/armani_jacket_scam.php

Looks like they were in the UAE a while ago.

http://7days.ae/looks-like-the-dodgy-suit-sellers-are-back-again

I guess the scammers get around, the name on the business card was practically the same as the second link (last name on the card was Mario). The business card had a Hotmail address -- another red flag that this person does not work for a well-known fashion company.

So spread the word that Italian Suit Scammers are wandering around Doha now.

Today I was out for a walk in the neighbourhood when a car pulls up to ask me for directions. The two guys said they were Italian, from Milan, and were in Doha for a fashion show (really? Doha doesn't have a lot of those.) and needed directions to their hotel. I gave them directions and they were so grateful he gave me a business card and wanted to give me a "gift". They had a lot of extra high-end designer suits in the trunk, and could sell some to me at a huge discount. They said they were flying out tonight and didn't want to take the suits back with them as it would be subject to customs tax.

I said no thanks and got out of there fast.

Why, because it's the Italian Suit Scam! The following links tell how it works (you're paying a lot of money for cheap knock-offs)

http://scam-detector.com/face-to-face-scams/italian-fashion-man

http://gothamist.com/2014/06/05/armani_jacket_scam.php

Looks like they were in the UAE a while ago.

http://7days.ae/looks-like-the-dodgy-suit-sellers-are-back-again

I guess the scammers get around, the name on the business card was practically the same as the second link (last name on the card was Mario). The business card had a Hotmail address -- another red flag that this person does not work for a well-known fashion company.

So spread the word that Italian Suit Scammers are wandering around Doha now.

Wednesday, April 27, 2016

The Saudi Transformation

So the other day came the big announcement from the Saudi Government that people in the region were waiting for, the ambitious overhaul of their economy to get rid of their heavy dependence on oil. It’s a long-term plan up until 2030, but the Prince said that it could take as little as four years to get rid of Saudi Arabia’s oil dependence.

I don’t have all of the details but some industry privatization is in the plan, notably selling a small stake of Aramco, the creation of a US $2 trillion (yes, trillion) sovereign wealth fund, and huge development in non-oil industries. It’s seems to be a really, really ambitious plan and those timescales seem a bit unrealistic but something does need to be done, the last couple of years of low oil prices has shown the Saudi Government the dangers of oil dependence. I believe the Government is burning through $9-10 billion of their own cash reserves every month now due to the lack of oil revenue.

There is one development that I’m looking forward to – tourism! The Government plans to spend on tourism infrastructure and thus allow more non-pilgrim tourists to visit the country. I’d certainly go. All the years I’ve been in the Gulf living right next to Saudi Arabia and yet I haven’t visited it. I’m not even sure at the moment you can get a non-pilgrim tourist visa to visit the country. If they allow more tourist visas and let non-Muslims wander around the country (obviously not to Mecca and Medina, there’s no way the country will let that happen) there’s a number of places I’d like to see – the Nabatean ruins in the north, Jeddah and Taif, some of the mountains around the Riyadh plateau, maybe even the dunes in the south.

Some news articles are already slamming the idea. The argument sums up as, “No booze or bikinis, why would anyone go?” I think that’s not a good way of looking at it, people should look at it as more of an exotic adventure rather than yet another all-inclusive drinks & beach holiday resort. In fact I hope the Saudis don’t go that route. There’s plenty of places in the Mediterranean if resort vacations are your thing.

If they make reforms right away I might plan a trip in 2017.

Tuesday, April 19, 2016

Dukhan Beach

This weekend a bunch of us went to a private beach in Dukhan, on the West coast. Qatar Petroleum has huge operations in Dukhan so have a private beach area with cabins, majlis and so forth. The host works at QP so arranged for us to stay at one of the sites for the day.

It was a decent sized place, with an indoor majlis (with a/c, though we didn't use it as the weather was great)

outdoor majlis

BBQ, and of course, beach access. The beach had three such places along it so it was fairly private.

So we spent the day swimming, then cooking up burgers and chili.

Relaxing on the beach

And chilling out in the outdoor majlis (with a big screen TV so people could play FIFA 16, as you do).

I had never been to Dukhan beach before and it was nice to get out there while the weather was great. With summer approaching these kinds of trips will end soon.

It was a decent sized place, with an indoor majlis (with a/c, though we didn't use it as the weather was great)

outdoor majlis

BBQ, and of course, beach access. The beach had three such places along it so it was fairly private.

So we spent the day swimming, then cooking up burgers and chili.

Relaxing on the beach

And chilling out in the outdoor majlis (with a big screen TV so people could play FIFA 16, as you do).

I had never been to Dukhan beach before and it was nice to get out there while the weather was great. With summer approaching these kinds of trips will end soon.

Monday, April 11, 2016

Souq Wakra

I got a chance to visit the souq in Al Wakra just before I went on vacation. I hadn’t been there in almost a year, and there was a lot of work left to do on the site, so I was looking forward to seeing it finished.

It’s not completely finished yet, there is still some construction for a few of the buildings and there was still work on the shore, but it has improved a lot since last year. More restaurants and cafes, some the buildings in the alleyways now have shops selling crafts and other things. I had heard the shore was becoming popular and I can see why, having all the cafes along the beach is really nice.

It should be great once it’s all finished.

Friday, April 08, 2016

Back from Vacation

Was away on a long vacation in Canada meeting with the family. It's great visiting Canada but man is it a long trip. A good 24 hours of travel to reach the West Coast. It'll take a few days to shake off the jet lag.

Sunday, March 13, 2016

Back to Shahaniya

So my friend invited me back to Shahaniya so that we could go over to a friend's place for dinner. This time he asked if I could wear one of my thobes.

Sure, no problem, I've started getting used to them.

Do I look Arab? Not really, primarily due to my brown hair and beard. If I dyed it black and wore sunglasses (so no one could see my grey-blue eyes) maybe from a distance no one would think I was a foreigner. I doubt it though.

As for Shahaniya it takes time to get there and, just like last time, there's further delays as you have to wait for camels.

So when I arrived my friend was running late so I sat in his outside majlis and watched the world go by (or camels, as the case may be).

After he arrived we went to the stables to see his camels. I posed for a picture with one.

Then . . .

lol, that tickled! Friendly camel.

Then off to dinner. I didn't take pictures as it was dark but after eating (goat meat on a bed of rice) one of the guys decided to fix my gurtra into a more casual bedouin style. Casual? More like my agal is slipping off my head.

And so ended another evening with Qataris and camels.

Tuesday, March 08, 2016

Shahaniya – Oud and Camel Races

The other day I was invited to a friend's majlis out at Shahaniya, where the camel racing tracks are. My friend owns racing camels and has a small holding area next to the majlis where he can keep his camels that he enters into races. Thanks to recent rain the weather was really nice so we spent most the time outside.

There's a big race coming up this weekend so there were competitors from all over the GCC there with their camels. Getting to my friend's majlis took a bit of time as once I got near the track I had to stop many times and wait for camels to go by.

So my friend and I, as well as a couple of other people we knew, were sitting on a carpet and chatting when an Indian man came up to them and started speaking Arabic. They answered back, chatted for half a minute, then he ran off and came back with another man and a big suitcase. I was a bit confused as to what was going on, my Arabic isn't good enough to follow conversations.

So the man then put the suitcase down and opened it.

It turns out he was an oud seller! He was wandering the neighborhood with his assistant and seeing if anyone was interested in buying oud wood and oud oil. A wandering oud salesman was definitely not something I was expecting, but later my friends told me that in Shahaniya it's quite common to see oud salesmen when there are lots of people around for a big race.

So my friends reviewed the oud, chatted and haggled, and in the end did not purchase anything. It turns out that the oud was QAR 6500 a kilo (~ US$1800, pretty expensive as far as I'm concerned but good quality oud can be far more expensive than that) and my friends felt that the quality of the wood was not great and did not justify the price. One of my friends wondered if there would be other oud sellers wandering by but no one else came. They joked it was because of my old Honda City parked out front as it would be a car that an oud seller would use -- the other sellers probably assumed someone was already there.

So if you’re interested there’s a big race coming up. On my way out of Shahaniya my friend pointed out a parking lot with the prizes, over 250 vehicles to be won (mostly Land Cruisers but there were two Bentleys!). If you want to see camel races try to get out to Shahaniya this weekend.

Friday, March 04, 2016

Oil Price and its Effects on the GCC

[Update: Coincidentally 2 days after I posted this Moody's announced it was downgrading Bahrain to junk and putting Saudi, UAE, Kuwait and Qatar on review for possible downgrades. Maybe they read this post ;-p ]

Occasionally friends back home ask me how the oil price is impacting the Middle East. Are there tons of layoffs? Empty buildings? Governments in financial trouble? Unless you’re reading the more serious financial newspapers for the most part all you’ll see is clickbait-worthy shock headlines (“Expert says Saudi Arabia will be Bankrupt in x Years!”) so it might not be the most balanced picture.

Don’t get me wrong there has definitely been an impact – a Government can’t have its income slashed by 50+% and just brush that off. Some countries are weathering it better than others, some have small populations and a large build-up of surpluses from the boom years to see them through the next while. Most have tightened their belts and cut spending and reduced subsidies, but how well it will work really depends on the country.

Now I’m not a huge expert on country analysis, and I don’t have access to all of the data, so I figured that I would put together a broad overview of each of the Gulf countries and how other agencies (IMF, credit rating agencies, etc.) have evaluated them.

Saudi Arabia

The largest of the Gulf countries, with a total population roughly 50% greater than the rest of the Gulf countries combined, problems here will inevitably ripple through the rest of the region. Oil makes up roughly 75-85% of the Saudi Government’s revenues and with their large population, as well as wars in Yemen and Syria that they are supporting, Government spending was big. There’s some murmuring in the media that consultants have been hired to develop a huge set of spending cuts for the Government, and subsidies on things like fuel have already been reduced, but there are probably some big spending cuts coming. Estimates are the Government spent $100-120 billion of their reserves in 2015 (maybe even more!) to offset the loss of revenue, something they can’t continue to do indefinitely, especially since in 2015 oil was hovering around $50-60 for much of the year, in 2016 it’s been more like the low-$30s.

Many analysts are worried. At one point during the boom S&P had Saudi Arabia rated at a quite respectable AA-, then last year downgraded them to A+. But two weeks ago they were downgraded again, to A- with a negative outlook, which means they’ll likely be downgraded again sometime over the next 12 months unless they make some big changes (to give you an idea of what an A- rating means it puts Saudi Arabia on a similar rating to Latvia and Malaysia). The IMF is pushing for Saudi to implement taxes such as a VAT to help make up for the lost revenue but I think a lot more will need to be done unless the oil price greatly improves.

Other rating agencies have been more optimistic than S&P and while they have put Saudi on a negative watch they haven’t done the big downgrades like S&P has. Perhaps they expect a rebound in oil prices.

Qatar

A much smaller country with a lot of oil & gas, Qatar is one of the countries that will weather the storm better than most other oil producing countries. They haven’t been sitting on their laurels though, there have been spending cuts, cancellations of many upcoming projects, reductions in some subsidies, and in a surprise move a recent announcement merging some Ministries and other Government organizations together to cut costs.

The 2016 budget calls for a deficit of about US$13 billion, based on oil averaging $48 a barrel. So far the price has been roughly 30-40% lower, if it continues then Qatar is facing a much bigger deficit. I expect that if oil stays at around $30-35 then in the summer we’ll see a revised budget with even more spending cuts.

The cuts are more proactive then driven by necessity, Qatar could probably fund big deficits for a decade or more given its huge sovereign wealth fund. Most analysts estimate that in the past Qatar would breakeven at around $60-65 a barrel (estimates for Saudi Arabia were over $100 a barrel), with the spending cuts the breakeven is now likely in the mid-50s so even a moderate uptick in the oil price would give Qatar breathing room and moderate deficits.

Analysts don’t seem to be too concerned about Qatar, at least for the short-term. S&P has kept its rating at AA, recently affirming the rating at stable, and the IMF was praising Qatar for the actions it was taking to reduce costs. Moody’s and Fitch have also kept their ratings for Qatar at the same high level.

Good news for Qatar’s austerity plan does not mean good news for people on the ground here, spending cuts means layoffs and as construction projects are completed there will be fewer projects starting so while the population has been relatively stable or even growing (growth in areas like construction jobs is keeping pace with layoffs in the oil and other sectors), layoffs in the construction sector are inevitable at current levels of spending. I expect the overall number of expats in Qatar to start shrinking in early-2017 unless oil rebounds.

Bahrain

Many people don’t realize that Bahrain doesn’t have a lot of oil, it was one of the first to develop its oil and because it is a tiny country (about 1/12th the size of Qatar) it did not take long to use a lot of it up so the country was not flush with cash like Abu Dhabi or Qatar. Much of the economy is still based around oil but there is also some reliance on money from Saudi Arabia, either through trade or tourism. Thus the drop in oil price impacts the Government’s revenues, but the ripple effect from Saudi adds an extra punch.

While it was once an oil-wealthy country things have been tougher over the years, and uprisings in 2011 didn’t help matters, so Bahrain did not have the high credit ratings of its neighbours. It was at a moderate BBB- rating from S&P but was recently downgraded to BB (similar to Costa Rica and Guatemala), which is in the ‘junk’ territory. This despite numerous reforms the Government has taken to try to cut spending and improve revenues. Fitch and Moody’s haven’t dropped Bahrain’s rating into junk territory just yet [update: 2 days after this post Moody's downgraded Bahrain 2 notches to match S&P's rating]. I’m assuming the ripple effect from Saudi was bigger than anticipated, or S&P expects that it will be bigger in the near future. The Government was planning to issue bonds to help cover the deficit but is now reconsidering due to the rating downgrade as they would have to offer the bonds at a higher interest rate. If they can’t fund the gap they’ll have to dig deeper into spending cuts.

Kuwait

In the same boat as Qatar: lots of oil, small population, tons of money in their Sovereign Wealth Fund to fund deficits, and a budget that did not require oil to be extremely high to make the books balance. Like everyone else they have been cutting spending anyway by removing or reducing subsidies on things like electricity and water, but unlike Qatar have also embarked on a program in 2013 to reduce the ex-pat population by around 100,000 a year for the next decade. The Government has gotten tougher about issuing residence visas, have stepped up police raids searching for illegal workers, and instructed Government organizations to try to do more to phase out ex-pat jobs (I assume so that they can be given to Kuwaitis).

Rating agencies have Kuwait rated the same as Qatar, the equivalent of AA (S&P), and don’t expect that to change in the near-term.

UAE

Actually seven emirates in one country and rating agencies tend to rate the emirates separately. In truth two of the seven dominate the economy: Abu Dhabi (largest economy, has the oil) and Dubai (2nd largest, not much oil but lots of tourism and property development). The other five, combined, wouldn’t likely be the size of Dubai’s economy.

Abu Dhabi is also similar to Kuwait and Qatar, the population is relatively small compared to the amount of oil it produces, did not need oil at $100 to run the Government spending, and it has the 2nd largest sovereign wealth fund in the world (after Norway) so has tons of money to fund any deficit. It too is rated AA by S&P and there haven’t been any threats of a downgrade yet. Moody’s does a rating for the entire country of the UAE as one entity, also the equivalent of AA.

Dubai is a bit trickier as there are no recent ratings by any of the credit rating agencies. If you recall, in 2009 Dubai hit a major crisis and had a financial collapse, triggered by the near-bankruptcy of Dubai World. S&P immediately issued big downgrades so in 2010 Dubai simply stopped paying the rating agencies to do any ratings. A Google search hasn’t found a rating since.

Dubai has recovered from the ’09-’10 meltdown, thanks in no small part to an emergency $25-30 billion (maybe more) from Abu Dhabi when everything was crashing, but while the Dubai Government does not rely heavily on oil (I think oil is <5% of the economy) the ‘ripple effect’ is hitting it. Dubai is a regional financial hub so can’t help but feel the bite when the neighbouring economies cut spending. Lots of tourists were from the GCC as well as Russia so thanks to the oil price and a strong US dollar tourist numbers and how much they spend are also decreasing. Reports note that property prices in Dubai fell around 10-15% during 2015 and the stock market has dropped around 10% in the last six months. It’s not looking too rosy but I highly doubt Dubai is anywhere near the level of financial trouble that countries like Bahrain are mired in, and they can count on some support from Abu Dhabi if things get tough.

Oman

Poor Oman. One of my favorite countries in the Gulf, and the people there so kind, yet it lacks the financial resources of its richer neighbors. The economy does rely heavily on oil just like everyone else, it's just that they don't have as much of it as their neighbours. I think the Sultan has done a good job with what he has but the country will never have the glitz and splash that the UAE and Qatar does.

Naturally this means the downturn in oil prices will hit the country hard. Unemployment will likely get worse (a touchy subject that in 2011 resulted in some protests in the country) and despite some spending cuts the government will run a significant deficit in 2016. If the oil price does not significantly improve Oman is looking at a very rough next few years.

This vulnerability has led to rating downgrades. S&P recently downgraded them from BBB+ to BBB-. Moody’s has also done recent downgrades and Fitch has been downgrading their ratings on some Omani banks. Oman's long-term debt is still investment-grade, albeit just above the line, and more spending cuts will be needed to prevent future downgrades. Like Bahrain this will increase the risk of political instability, though I don’t think Oman would ever reach the level of problems that Bahrain has in this regard.

So that’s the summary. Basically not a rosy picture. Some can weather the storm but others are going to really face issues if oil continues to remain low in the long-term.

Monday, February 22, 2016

Qatar Total Open

The ladies tennis tournament, the Qatar Total Open, has started, and I was fortunate enough to get an invite from a friend for the first day. It was VIP tickets, something I've never had before, so I figured that meant we had box seats somewhere.

When we arrived he asked if I wanted something to eat first as there was a buffet. A buffet!? So we went into the VIP area behind the stadium and sure enough there was a huge buffet hosted by the Four Seasons Hotel, with sushi and a wide array of other foods, along with tons of wait staff and a jazz band.

Here's a reenactment of my expression:

(only more handsome and with a goatee)

Luckily there were lots of TVs so we could also see the tennis while we had something to eat. And who did I see playing a match? Eugenie Bouchard, Canada's top ladies tennis player! That was awesome, I knew that Serena Williams and Maria Sharapova both had to cancel coming to the tournament so I was a bit worried that there wouldn't be anyone there I'd root for.

Eugenie had a rough match and I watched with apprehension as she went down 0-4 in the third set. Amazingly she managed to claw it back to serve, had some nail-biting moments saving TWO match points, then went on to win the match. Geez, could that get any closer?

We also met up with an Indian friend who was hoping to see Indian tennis legend Sania Mirza play doubles but unfortunately she wasn't playing that day. We chatted about the impact she has had in India being one of the few tennis stars from that country. I recall in 2006 seeing her play at the Asian Games here in Doha and how there was a huge crowd of Indians there just to watch her.

Anyway here's hoping I'll go see some more matches (doesn't have to be VIP, I'm not choosy).

When we arrived he asked if I wanted something to eat first as there was a buffet. A buffet!? So we went into the VIP area behind the stadium and sure enough there was a huge buffet hosted by the Four Seasons Hotel, with sushi and a wide array of other foods, along with tons of wait staff and a jazz band.

Here's a reenactment of my expression:

(only more handsome and with a goatee)

Luckily there were lots of TVs so we could also see the tennis while we had something to eat. And who did I see playing a match? Eugenie Bouchard, Canada's top ladies tennis player! That was awesome, I knew that Serena Williams and Maria Sharapova both had to cancel coming to the tournament so I was a bit worried that there wouldn't be anyone there I'd root for.

Eugenie had a rough match and I watched with apprehension as she went down 0-4 in the third set. Amazingly she managed to claw it back to serve, had some nail-biting moments saving TWO match points, then went on to win the match. Geez, could that get any closer?

We also met up with an Indian friend who was hoping to see Indian tennis legend Sania Mirza play doubles but unfortunately she wasn't playing that day. We chatted about the impact she has had in India being one of the few tennis stars from that country. I recall in 2006 seeing her play at the Asian Games here in Doha and how there was a huge crowd of Indians there just to watch her.

Anyway here's hoping I'll go see some more matches (doesn't have to be VIP, I'm not choosy).

Sunday, February 14, 2016

Desert Roses

For Valentine’s Day I thought I’d mention a different kind of rose, of which I keep a bowl of at home.

These rose-looking objects are actually a crystal that grows in deserts near areas where there's salt. Called ‘desert roses’ there is at least one place in the southern deserts of Qatar where they can be found. I’ve been there twice, along with other groups of people, essentially mining the area for these roses. For the most part you have to dig a bit to find them.

But if you're lucky sometimes the wind removes the top layer of sand, exposing them, as shown by my Mother.

While they may look like small rocks in fact in Qatar they form an entire layer of the basin so once you hit that layer you have to break through to be able to chip roses off. The layer is quite hard and a shovel usually isn't usually enough, you need a pick or similar mining tool to get through it. It can be tough work in the sun.

They are pretty though. Unfortunately too many people were digging them up so now many groups don’t do excursions to the basin anymore. The crystals can take decades to form and they were getting depleted by all the ‘mining’. I haven’t been for at least five years and don’t intend to go anymore, I have some so no need to get greedy. My best specimens are gone though, if I have guests over they always admire them so I usually give them a nice one as a gift to take home. They make lovely souvenirs, shame they don’t grow quickly.

So why tell you about desert roses? Well, if you ever visit Qatar there is a new National Museum being built, and the architecture is making some people go WTH?

And now you know what inspired the new Museum building.

Subscribe to:

Posts (Atom)